Venturo is an innovative SaaS platform designed to simplify employee stock option management. It empowers individuals to track their equity, minimize taxes, and maximize earnings without the need for costly financial advisors. Tailored for tech employees aged 22+ with Incentive Stock Options (ISOs) or Non-Qualified Stock Options (NSOs), Venturo transforms complex equity compensation into actionable insights.

Another common scenario involves planning for a liquidity event. Users can leverage the Sale Calculator to simulate selling their stock options under various market conditions, factoring in federal and state income taxes, and capital gains. This allows them to confidently plan their exit, ensuring they maximize their after-tax proceeds and make informed financial decisions. Venturo also serves as a central hub for tracking all equity grants, providing a clear, real-time overview of vested value and future potential, which is crucial for personal financial planning and wealth management.

Key Features

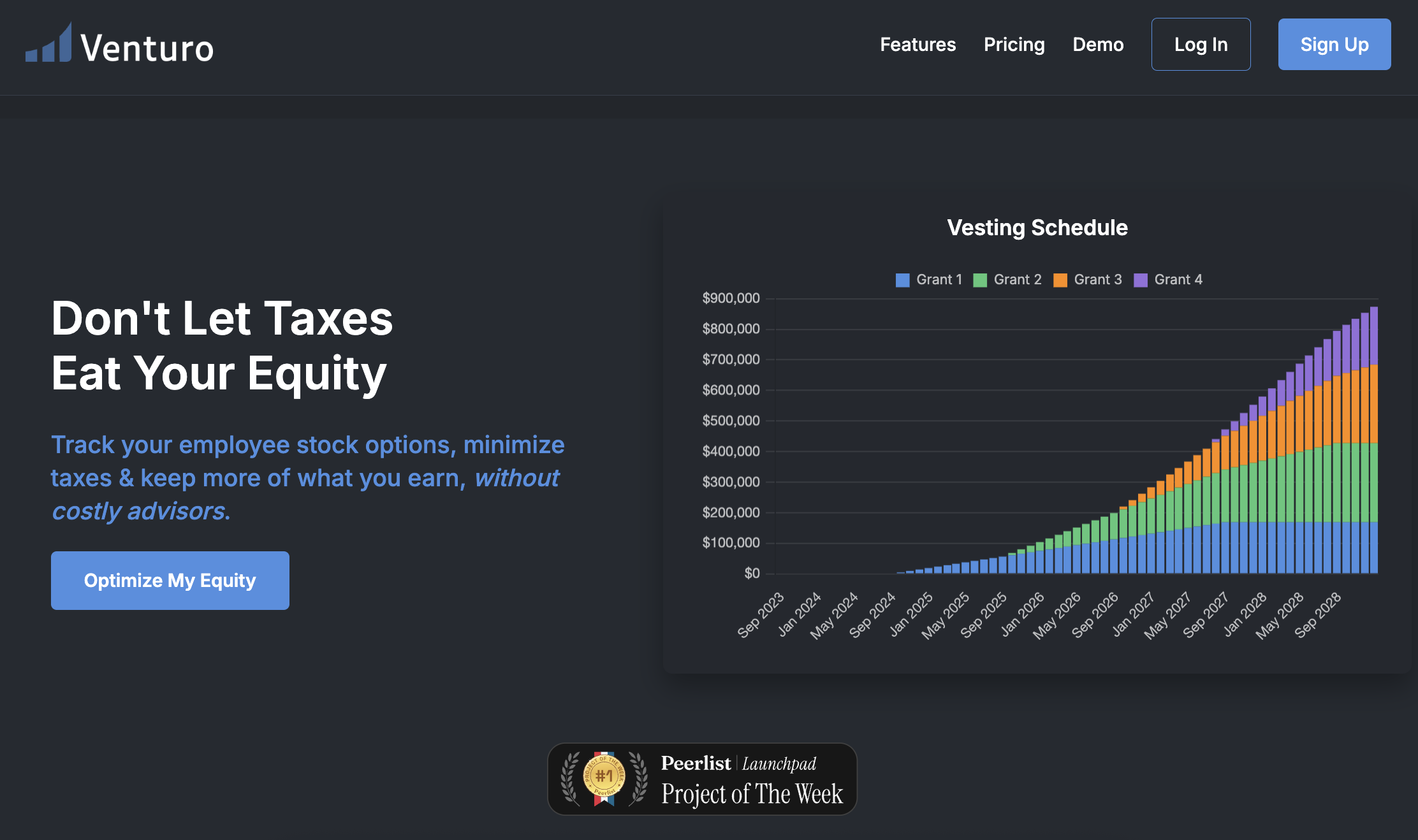

- Comprehensive Equity Tracking: Monitor all equity grants, exercised units, and vesting schedules in one intuitive dashboard with clear visualizations.

- Advanced Tax Optimization: Utilize sophisticated tax simulation tools, including an AMT Calculator and Sale Calculator, to minimize tax impact and maximize savings.

- Customizable Vesting Schedules: Model intricate stock option grants with flexible, month-by-month editing for nuanced vesting scenarios.

- Exit Planning Confidence: Simulate various exit scenarios to maximize after-tax proceeds when selling stock options.

- Automated Tax Data Updates: Automatically uses the latest federal and state tax rates and brackets (e.g., 2026 data) for accurate calculations.

Use Cases

Venturo is ideal for tech professionals navigating the complexities of their equity compensation. For instance, an employee with ISOs can use the platform's advanced AMT Exercise Calculator to model different exercise dates and quantities, understanding the potential Alternative Minimum Tax implications before making a decision. This prevents unexpected tax burdens and helps optimize their exercise strategy.Another common scenario involves planning for a liquidity event. Users can leverage the Sale Calculator to simulate selling their stock options under various market conditions, factoring in federal and state income taxes, and capital gains. This allows them to confidently plan their exit, ensuring they maximize their after-tax proceeds and make informed financial decisions. Venturo also serves as a central hub for tracking all equity grants, providing a clear, real-time overview of vested value and future potential, which is crucial for personal financial planning and wealth management.

Pricing Information

Venturo offers a flexible pricing model, including a robust freemium option. The "Standard" plan provides free basic dashboard access, unlimited grants, customized vesting schedules, and "What-If" analysis. For advanced features like the Tax Optimization Module, AMT Calculator, and Sale Calculator, users can upgrade to the "Premium" plan at $100/year. An "Enterprise" custom plan is also available for organizations requiring multi-user access and advanced reporting.User Experience and Support

The platform boasts a sleek, dark-mode interface optimized for both desktop and mobile devices, ensuring an intuitive and easy-to-use experience. Interactive charts and clear visualizations make complex data digestible. Venturo is committed to accessibility, striving to comply with WCAG 2.1 guidelines. Support is available via email at support@getventuro.com for questions, feedback, or accessibility assistance.Technical Details

Venturo is built with a robust Flask-based backend, ensuring secure and efficient data processing. It utilizes Supabase for secure data storage and authentication, providing a reliable foundation for user data. For dynamic visualizations and interactive charts, the platform integrates Chart.js. Payment processing for premium subscriptions is seamlessly handled through Stripe, offering a secure and convenient transaction experience.Pros and Cons

Pros:- Simplifies complex equity compensation management.

- Advanced tax simulation tools (AMT, capital gains) for optimization.

- Automated updates for federal and state tax rates.

- Intuitive dashboard with clear visualizations.

- Affordable alternative to traditional financial advisors.

- Supports both ISO and NSO grants.

- Currently in MVP phase, some features may be incomplete or subject to change.

- Calculations rely on user-provided data and specific assumptions (e.g., standard deduction, single AMT preference item).

- Does not yet support "Married Filing Separately" or "Head of Household" tax statuses.

- Users are responsible for verifying the applicability of tax data to their specific situation and consulting professionals.

Conclusion

Venturo offers a powerful, accessible solution for anyone looking to demystify and optimize their employee stock options. By providing clear tracking, advanced tax simulations, and intuitive tools, it empowers users to make informed financial decisions and maximize their equity's value. Explore Venturo today to take control of your equity compensation journey.Comments

Publisher

Focus Apps

Launch Date2026-01-26

Platformweb

Pricingfreemium

Tech Stack

#Flask#Supabase#Stripe